This month we are looking at a basic strategic tool: The SWOT analysis.

Last month I facilitated a strategic planning workshop for one of our clients. As I introduced the session on SWOT someone said “I’ve done that so many times and it’s just the same old stuff”.

That was not the first time I have seen that response. SWOT has been around for over 50 years so it is familiar to just about anyone who has been to a strategic workshop.

Consultants like to keep things fresh so they sometimes come up with other models and tools such as Blue Ocean, Hoshin, Porters 7 Forces, Appreciative Inquiry and Ansoff’s Matrix.

All have their place but few are as easy to use as the SWOT.

So why don’t people get excited about the SWOT? I think it’s because it is easy to fill out but then is often left as an exercise on the day rather than used to leverage some actions. It seems too simple and therefore gets underrated.

So, let’s have a look at the SWOT Analysis tool and see what it can do for you.

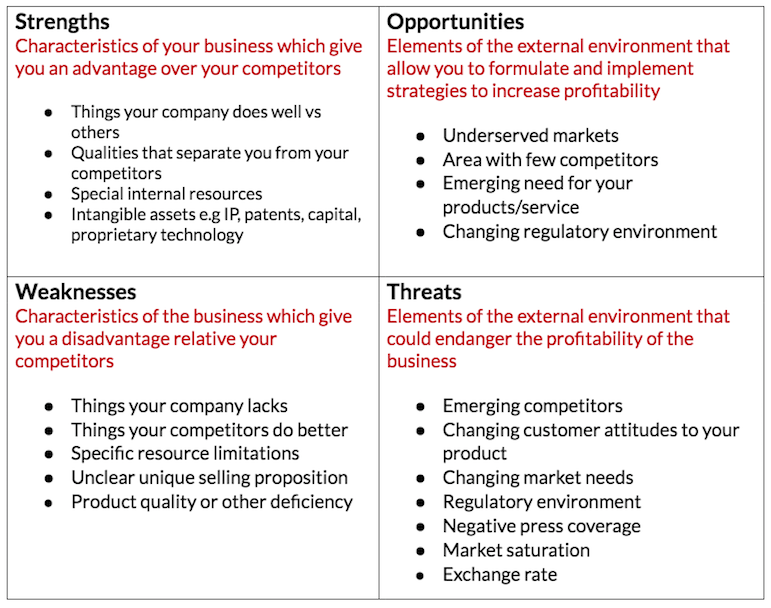

Below is the traditional matrix which shows the four parts of a SWOT: Strengths, Weaknesses, Opportunities and Threats.

The Strengths and Weaknesses refer to your own business. What makes your organisation strong compared to your competitors.

Often a SWOT process goes wrong at this point because participants simply list things that any organisation could write: Great staff, Good product, Well known etc. You have to be more specific than that. Think of your relative strengths that few, if any, of your competitors can claim.

My questions are:

- “Are your staff more ‘great’ than your competitors? If so in what way (answers might include greater industry knowledge for example).

- “What makes your product more ‘good” than your competitors (is it cheaper? stronger? easier to use?)

- Is “being well known” a strength? For example, is this a sector where people like variety? What are you well known for?

I ask questions which require my clients to think about comparative strengths and weaknesses. If everyone in your industry has well qualified staff (for example because all vets must be qualified) then it is not s strength but simply a requirement to be in business.

The other characteristic of a strength or weakness is that you can often do something about it. If your weakness is under qualified staff, you can develop a strategy to upskill your staff. If your strength is being located on a high profile site, you can develop a strategy to leverage that site.

The objective of listing your strengths and weaknesses is to develop actions to make your strengths work harder for you and mitigate or eliminate as much as possible the weaknesses.

Threats and Opportunities are factors which happen outside your business rather than in your business. These are what economists call externalities.

These externalities may affect you more than your competitors (for better or worse) or may be something that is common across the sector.

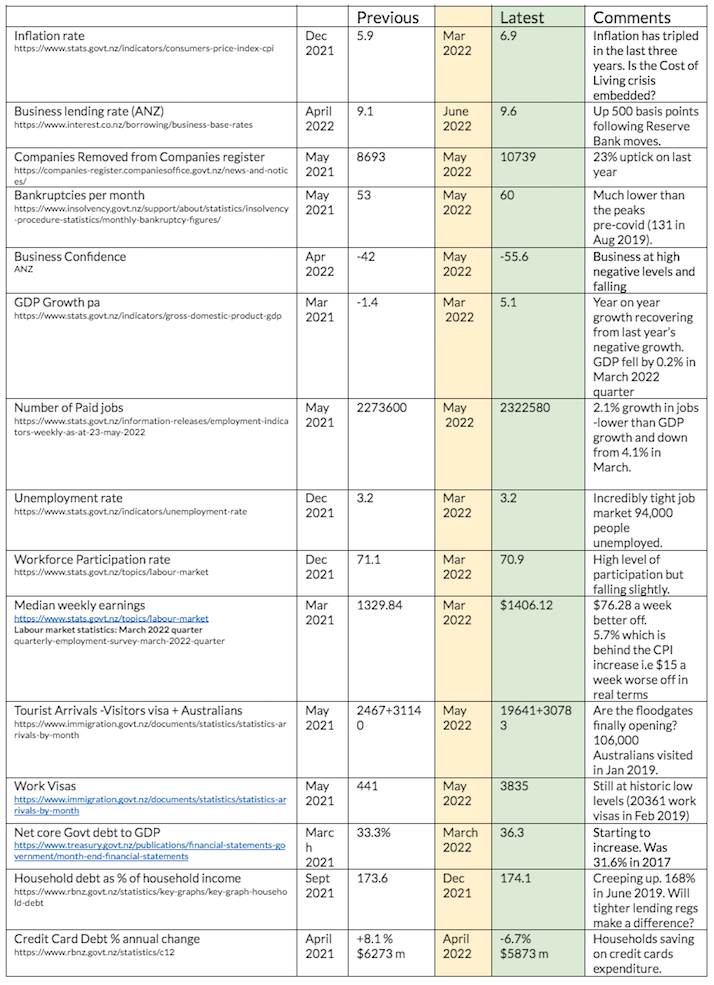

The table of statistics attached every month to my newsletter give samples of externalities that are relevant to different sectors. Notice inflation is getting worse -How does that affect your business? What about the rapid increase in visitors from overseas? How are median wage changes affecting your business?

To help think about the externalities for your organisation you can use the acronym: STEEPLE which stands for Social changes, Technology changes, Economic changes, Environmental changes, Political changes, Legislative changes, Ethical changes.

Ask questions under each of those headings and identify any changes that might be relevant to your organisation.

Your sector may well be affected by changes in legislation: For example, I chair SILC which supports people with disabilities. How does the new Ministry for Disabled Persons change our business environment? What about the dis-establishment of DHBs?

Under Economic we might ask “If house prices are beginning to fall will that make it easier or harder for SILC to find accommodation for the people we support?”

Technology changes allow people to research SILC. We ask “How does our website stack up?”

I hope you can see that the SWOT exercise does not stop once you have listed the Strengths, Weaknesses, Opportunities and Threats. That is just the beginning. The next step is to ask questions.

That is where I, as your workshop facilitator, will add value to your strategic planning. I ask and test the answers as to what each of those factors mean for your business and coax you to come up with specific actions which will protect you from threats, minimise your weaknesses, capitalise on your strengths and set you up to take advantage of opportunities.

Give me a call today to help with your strategic planning.

ACTION

- Have the Board create a SWOT matrix. Start by filling it out as individuals which avoids groupthink and then discuss what you decide are the top three issues in each box.

- Have a facilitator such as Ron come in to help you create an action plan.

STATISTICAL CONUNDRUM

“Domestic animals expect food when they see the person who usually feeds them. The man who has fed the chicken every day throughout its life at last wrings its neck instead, showing that more refined views as to the uniformity of nature would have been useful to the chicken”.

-Bertrand Russell, The Problems of Philosophy

This could easily be an allegory where you are the chicken and the man is Government but this month the bigger lesson is about how we interpret the evidence we see in front of us.

I have lost count of the number of people who have blamed “Covid” for not being able to deliver. And more recently “Ukraine” has become a replacement excuse for poor service.

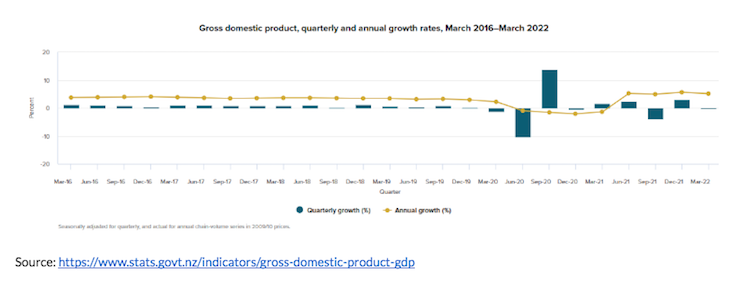

Look at the chart below which shows GDP growth over the last six years. Notice that the average quarterly GDP growth was 0.97% for the 8 quarters up to March 2018. For the next 8 quarters up to March 2020 the average growth was less than half at just 0.46%. Remember we did not have the lock down until mid-way through March 2020 so something was happening long before Covid hit our economy. Something happened at the end of 2017 which caused our economy to suddenly halve its growth from 2018 onwards. Long before Covid. Long before Ukraine.

Conversely the average quarterly growth from March 2020 to today has been 1.76%. That is almost twice as much as the earlier stable period prior to 2018. In other words, economic activity has been historically high, albeit very volatile ranging between 13.7 quarterly growth and 10.3% quarterly retraction.

The conundrum is why are people blaming covid and war given our economic activity is so good?

So, if you are the chicken, are you making assumptions about the evidence in front of you?

I have used GDP to illustrate but you should reflect about what narratives you accepting in your business which just might not be as true as you first thought?

Understanding your business environment better will give you more opportunity to grow your business. Go ahead. Think about it!

LET’S TALK STATISTICS

Numbers tell a story. How do these numbers tell a story for your business?

I have included a random range of statistics. Please let me know other statistics you would like to follow.